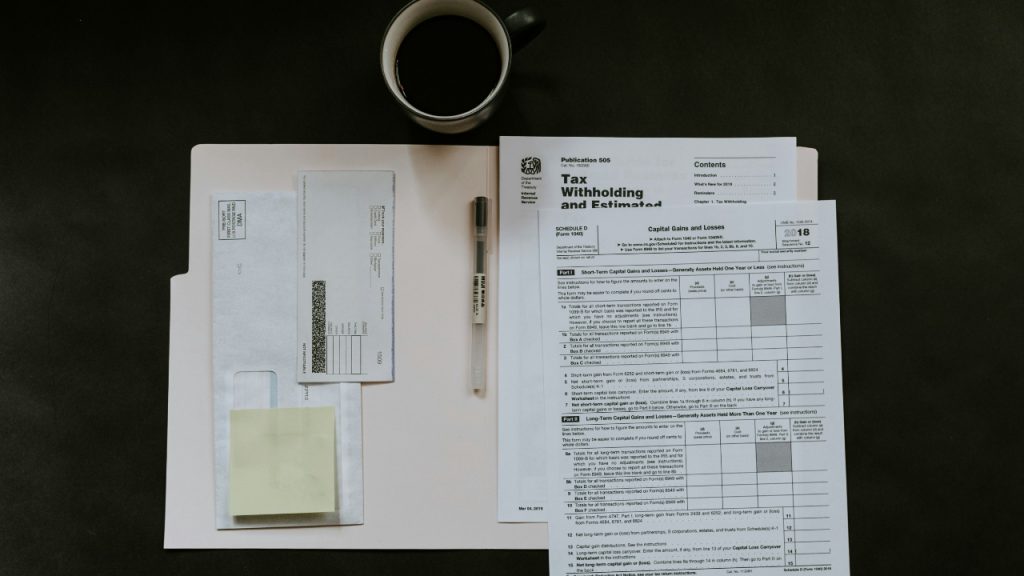

Tax-Write Offs for Beauty Industry Business Owners

If you’re a beauty industry business owner, you’re probably familiar with one of the first things you learn. Running your own business is an expensive proposition! Even before you open your door, everything costs money. While investing in your business makes sense, the expense can feel overwhelming.

Something most business owners have in common is the ability to look on the bright side. It’s hard to do when it feels like you’re pouring your hard-earned money into laundry service and replacing waxing tools.

But, during tax season, that silver lining starts to show. Savvy business owners know that tax write-offs can change your perspective. Today, we’re looking at how to maximize your returns each year when it’s tax season.

Let’s get started!

5 most common business expenses of beauty businesses

Some recurring expenses can’t be avoided when you’re building out your business. Each beauty business owner invests time and money into these five things that could be a tax write-off!

Rent on a salon or spa

You’ve had to pay rent since first going out on your own as a self-employed beauty operator. Renting a booth or room at a salon as an independent contractor might have been your first experience. As you grow your business, you may even start renting your own shop. These are necessary expenses that often are your biggest source of operating costs.

Building your business is expensive, and you might not have enough capital to get off the ground. Taking out a business loan can provide essential funds to launch your new salon. You can’t deduct the principal amount, but in most cases, you can deduct the interest you pay over the year.

The IRS considers renting your workspace a business expense that can be claimed on your taxes. Even for those working out of their homes, the space you use counts as part of your business!

Use this IRS table to calculate the percentage of your home office you can claim.

Operating costs and utilities

We all know that rent isn’t the only overhead related to your workspace. Things like utilities, repairs, and regular maintenance fall into what are called operating costs. If you have a cleaning service or work with a business accountant, those fall into operating costs.

They can also include marketing, advertising, travel costs, and mileage if you travel for work. Just don’t try to claim your parking tickets!

If you have a cell phone that you use for your business, you can even deduct your phone bill.

Website development, business cards, and advertising expenses can add up. If you don’t have the expertise to do them yourself, you’re likely working with a branding agency, too. You can write off these as operating costs for your business!

To deduct these items, they must fall into what the IRS calls “ordinary and necessary.” So, costs that are typical for beauty industry businesses would count in this category.

The cost of equipment and supplies

Beyond your space, equipment and supplies are regular big-ticket items you need for your business. Depending on your services, you may need wax warmers, spa tables, or specialized skincare equipment. Building out your waiting area with a reception desk, comfy chairs, and displays for products are essential.

Any supplies you use during your job, from wax applicators to aftercare products, are considered business expenses. And any products that you stock for sale to your clients fall into the same category.

They’re all potential write-offs!

Look into all the employee-related expenses

Beauty bosses know that happy employees are essential to your business. Employees earning a salary expect things like health insurance and other benefits as part of the deal. You may even have part-time employees who you want to offer some benefits. This can get expensive fast, even with your team paying part of the costs.

You may also want to have your team working in uniforms, especially if you’re in the med spa space. Scrubs, aprons, and dry cleaning are expenses you can claim for your business.

Professional development is another necessary expense. Keeping your license current and those of your employees helps you stay up with trends and maintain your CEUs.

Health insurance premiums, continuing education, uniforms, and licensure fees are all tax deductions you can claim!

Anything related to insurance

Every beauty business needs liability insurance to protect against potential lawsuits. But you’re probably also paying premiums to protect your investment that goes beyond simple liability. Premiums can be expensive, but rest easy knowing that you can write them off at the end of the year!

How to address tax-write offs

When it’s time to file your taxes, it may be tempting to try to claim everything. But this is a great way to end up on the wrong side of an audit. Instead, take a measured approach and keep track of your actual expenses.

Keep track of your expenses

Keeping track of your expenses is essential if you plan to claim them on your taxes. Small business owners get into trouble when they blur the lines between personal and business expenses. As soon as you start your business, you should open a business bank account to keep them all in one place. This helps you track your expenses and have concrete numbers to claim on your taxes.

We know it’s not always possible to keep all of your expenses separate. In these cases, keeping up with receipts is essential. Snap pictures or keep the physical version handy. Most business accounting software allows you to upload your records regularly.

Consult with tax professionals

Tax laws constantly change and impact your business differently from year to year. Especially if you’re self-employed, they can feel overwhelming and cause unnecessary stress.

Working with an accountant specializing in small business accounting can be a game-changer. They have the expertise to answer your questions and suggest maximizing your tax write-offs.

They can also help you with tax planning, record keeping, and tax preparation each year.

In the event of an audit, they’re in your corner to help protect your assets and support your claims.

Contact other estheticians on their experiences

There’s no reason to reinvent the wheel when plenty of estheticians and beauty professionals have experience with tax write-offs. Work with your mentor or reach out to respected members of the profession for advice. They can tell you what did and didn’t work for them and suggest systems to help you stay on top of your tax responsibilities.

For all questions regarding running an esthetics business, Bosses in Beauty is here for you!

Running your own beauty business is rewarding. But trying to figure out whether you can write off the latte you brought your client is a headache. Bosses In Beauty is here to provide the best education and information to current and future estheticians around the globe. Let our experiences save you time and stress!

Reach out to us today for expert advice!

The

6-Figure Beauty Business Blueprint

An 8-week live program for solo estheticians who want to attract more clients and hit their first six-figures using our proven 6-figure blueprint.

Build Your

7-Figure Team

An 8-week live program for beauty professionals ready to hire, lead and scale their team to seven figures and beyond.